Online invoice discounting or The Trade Receivable Discounting System (TreDS) is a business setup helps micro, small and medium enterprises (MSMEs) that requires cash to raise funds by selling their trade receivables to corporates.

In 2014, The RBI introduced TreDS platform which is an online secured platform for trade receivables financing for MSMEs. There are three main parties involved in a transaction, usually the MSME Supplier, Corporate Buyer and Financier. These three parties come together with the help of this platform and are able to upload, accept and start the financing process. Only MSMEs can participate as the sellers on the platform and banks and other financial institutions can only play their part as a financier.

MSMEs can easily get credit on this online invoice discounting platform rather than applying for old school traditional loans. In TreDS a company or business owner sells an invoice to a finance which can be a bank or another financial institution, due on some particular future date. The business owner gets funds or credit based on their invoice.

What Is The Process?

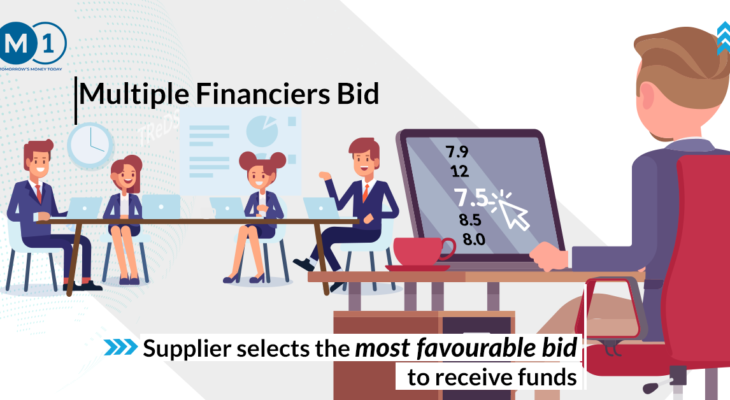

Micro, Small And Medium Enterprises (MSMEs) who are looking for funds comes on board and uploads a bill (Invoice) on the platform. An interested buyer then has to accept it which further goes on to become a factoring unit, electronic auction involving bidding for the factoring unit takes place on the platform. Now the Financiers come in at and bid at different discount rates.

The Seller then agrees on the discounting rate which is suitable according to them and TReDS then initiates the deal by taking the amount from financier and transferring the amount to the seller. Once accepted by the seller, the amount is credited on a T+1 or a T+2 basis. This is a fully automatic process and all the instructions are sent electronically by platform to all the participants. On the date of the invoice the bank account of the buyer is debited automatically and the amount is credited to the financier.

By this MSMEs get good access to finance, at lowest interest rates in a transparent manner without providing any additional collateral. TreDS platform also helps MSMEs to save time as It is not possible to visit ten different banks in order to attain best rates. With this online platform the owner can find the most competitive rates at his own convenience and focus more on growing his business rather than finding various sources of finance.